WHILE DROPPING IN ON the CRTC’s two-week hearing into new and renewed mandatory carriage requests (on cpac.ca) – and poring over some of the transcripts since its conclusion, two thoughts bubbled up above all the facts, self-serving opinion and pure BS that is a Commission hearing: The CRTC should impose some sort of mandatory penetration based rate card, a-la Bell Media’s, upon the entire regulated TV industry – or just deregulate the whole damn thing (which is not actually an option).

Independent broadcasters (those not owned by a vertically integrated entity) have little, if any, leverage when it comes to negotiations with the big Canadian BDUs. Their businesses – and commitments to Canadian content contained in their licences – rely profoundly on the packaging decisions of the Canadian cable, satellite and telco TV carriers. That can’t be sugar coated. In general, their programming is niche (popular among its viewer base, but niche) and without one or two Big Breakout Hits, which Canadian independent broadcasters often lack, they have little to bargain with and instead gain carriage deals thanks to regulatory fiat – be it 9(1)(h), dual status, or linkage rules. However, because of that, the big BDUs often treat independent broadcasters like unworthy annoyances, and not the partners they are.

We heard April 25th from one of the oldest Canadian independent specialty brands that its 25-year run may come to an end without continued Commission protection – via 9(1)(h). Without the protection of must-carry/must pay status we heard Vision TV would either lose its slot within the basic packages of most BDUs, and instead be forcibly relocated to a lightly penetrated tier, or would be allowed to stay on basic but at a dramatically lower rate than the $0.12 per sub per month it gets now, if not right down to zero.

These things will probably happen to ZoomerMedia’s Vision TV without Commission intervention, in my view. Vision executives pointed to a number of things it says BDUs have perpetrated on the company in the past few years while waiting for this hearing as proof the channel will have its subscription revenue slashed to the bone if it is not aided by regulation. ZoomerMedia’s VP of television program distribution (the guy who deals directly with the BDUs), Tony Greco, told the panel of commissioners during the company’s appearance that he had a file called “BDUs gone wild” as proof his carriers won’t and don’t think twice about elbowing the independent broadcasters around.

“The announcement of deregulation it was like ringing the dinner bell,” said Greco during Zoomer’s appearance two weeks ago. “Once deregulation was announced, we were unable to secure a single BDU even interested in sitting down and discussing contract negotiations. We did renew several… but they only go to the end of the dual status period… So, that was the first indication that our BDU friends were waiting to see what would happen once that dual status expired.”

Greco then noted that during Rogers Cable’s 2011-12 London market trial of a cheaper, more flexible way of packaging channels, Vision was not part of the basic service offered to test customers there. “When Rogers did its test in London, we weren't on skinny basic, notwithstanding the fact we were administratively renewed as dual status until August 31st 2013. We advised the BDU that… it was required by the Commission we be carried and (they) said, ‘well, we don't recognize that.’ We went back and said, ‘we have a contract with you, an affiliate agreement with you, that goes to December 21st 2012. How about that?'

“Take us to court… call it undue preference, call it whatever you want. Take it to arbitration,” Greco recounted being told.

"So at the end of the day we have to assume that if, while we’re under dual status with the Commission and under contract with the BDU, and they would take us off of basic and we are not in any of the marketing content that they have provided to the public… We think that's an indication of where things may go if we don't have protection,” concluded Greco.

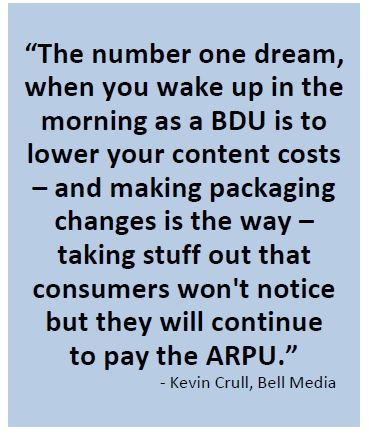

BDUs are all facing dramatic upswings in content costs from some broadcasters (think sports, U.S. cable channels) – and they desperately want to minimize any other spending any way they can. Kevin Crull, the president of Bell Media, during last year’s penetration based rate card battle with independent carriers, recalled his days as head of Bell Residential Services, which includes Bell TV:

“The number one dream, when you wake up in the morning as a BDU is to lower your content costs – and making packaging changes is the way – taking stuff out that consumers won't notice but they will continue to pay the ARPU.”

What that means is customers will pay the same monthly rate no matter what their BDU alters, while the broadcasters being shuffled around the channel lineup to a lower penetrated tier, or having its wholesale rate slashed, takes it in the chin. While for the BDU, average revenue per user is maintained (or grown) as costs are cut because the retail price never falls, or even rises, despite any lineup shuffling..

Telus, too, said the same during its appearance during the 9(1)(h) hearing. CRTC chairman Jean-Pierre Blais asked Telus outright that if it were to cut the wholesale rates paid to a channel which had been mandated to be on basic whether its TV customers would see a retail rate decrease. It was a long answer, but the gist was, essentially, “no.”

While talking about saving a few pennies per month on trimming Vision’s wholesale rate, as the example, Telus’s VP home solutions, Greg Goodwin said: “The savings wouldn't be such that it would change pricing by $1 or $2 and absolutely we would look to reinvest in applications and innovation on our system.”

So, we have an independent broadcaster who says it must continue to have basic penetration lest its revenue crash – and there are hundreds of stories of independent channels over the years shifted from tier to tier with no warning, or having rates slashed with no reasoning, causing serious subscriber losses and dramatic upheaval at those companies.

So that brought Bell Media’s penetration based rate card to mind. This rate card demands that the company’s channels (TSN, especially) be placed on a well-penetrated tier (or basic) to get the best wholesale rate and if they aren’t, the BDUs are charged more to “make whole” whatever revenue the Bell Media channel would have earned on the higher penetrated tier, due to subscribers no longer paying and advertisers losing eyeballs.

You could almost call it dual status via commercial contract.

When it comes to American channels, there is no such rate card. Their rates, climbing all the time, are tied directly to highly penetrated tiers (if not basic cable) which are non-negotiable. And don’t even think about a-la-carte CNN, or Golf or Spike or any of the others. That’s just not allowed.

The Zoomer team referenced one of those U.S. channels in its appearance, HLN. The Time Warner-owned channel used to be the relatively staid Headline News service but with news as a commodity nowadays, it had to change and now heavily features a broadcaster, the ludicrous Nancy Grace, who seems to make as many headlines for what she says as the subjects she covers., The channel is receiving healthy rate increases. The Turner-owned channel, said Zoomer’s outside counsel Mark Lewis “is up to $1 (per sub per month) and that rate has increased 28.5% over the last four years,” despite lower viewership than Vision. “So what is happening is, obviously to us, we're getting pushed back on our regulated rate of 12 cents under dual status,” he added. “Now that we're in negotiations there are further push backs of additional fees and possibly no subscriber fee whatsoever to us – and these American services are making out like bandits.”

(UPDATE: Rogers officials pointed out to Cartt.ca that the company refuted the fact it pays $1 per sub per month for HLN during the hearing. Rogers SVP video David Purdy told commissioners then: "I was intrigued by one comment that was made earlier, that cable companies are paying $1.05 for Headline News. We don't pay one tenth of $1.05 for Headline News," he said. We at Cartt.ca missed hearing that and regret not publishing Rogers' rebuttal when we originally published this piece.)

So the question is, why can’t a channel like Vision try demanding a rate like HLN, or imposing its own penetration based rate card like Bell Media and demanding to be made whole if shifted, as Greco told the commissioners “to some doo-doo package”? Simple. They – and the other independent broadcasters – are just too small, without the financial power or mass-market popular programming to force such a thing.

ALL OF THAT SAID THOUGH, a hard question for Zoomer and the CRTC has got to be: Is Vision worth 12 cents per month from every Canadian subscription TV household? Where are its hits? What are its must-watch shows?

We’ve seen just recently some hardball tactics from U.S. cable channels and Canadian BDUs. Viacom channels Spike and BET were removed from Telus Optik TV earlier this year in a rate dispute, to seemingly few complaints, while AMC played hardball with Rogers and won. Why? AMC has Mad Men and Breaking Bad, two shows that are breakout hits for the one-time classic movies only channel. Spike and BET do not have shows of the same popularity or cachet.

Rogers SVP of content, David Purdy, gave Vision some advice during his appearance before the Commission on what it needs to do to stay carried and paid, sans regulation. “If I worked for Vision I would be securing the long term multiplatform rights for Downton Abbey and I absolutely would be trying to leverage from guys like myself a higher wholesale fee and continued distribution.” Vision has been carrying the uber-popular PBS drama in repeats.

“The challenge we have when looking at Vision is, it is a popular ratings-driven service? In which case, it should have operational leverage that allows for it to negotiate a wholesale fee. Or is it a must carry religious service? They seem to be straddling both camps. I think that's the challenge we have with the service. We can't figure out if they are fish or fowl, which is why we have not done a long term renewal with them,” continued Purdy.

“We need them to decide are they a religious faith-based must carry service or are they a popular service that shows Eastenders and Downton Abbey.”

So what’s the answer? Does the Commission, faced with knowing BDUs are likely to continue to dream about lowering content costs while at the same time boosting ARPU (often at the expense of non-vertically integrated broadcasters) continue with the status quo, picking a few protected winners who must be paid for by everyone?

As we’ve written, the time for adding more new channels to what we must pay for as consumers is over, with some exceptions relating to accessibility and minority programming. But what if our regulations have created a protected nest of specialty broadcasters, too willing to enjoy the influx of dollars generated by our regulated market to take big programming risks and create a Mad Men or a Breaking Bad, or Duck Dynasty or Dexter?

What if our regulations, designed to build and nurture great Canadian content, are instead standing in the way of a Big Breakout Hit, one that Canadians can’t imagine not having in their TV lives?

There are no easy answers. What are yours? Please let us know by dropping us a line at editorial@cartt.ca. We’ll keep it all confidential if you wish.