WHILE VOICE IS COMMODITIZED and data is monetized as we increasingly move into a smartphone world, wireless pricing plans are undergoing radical changes in lock-step with burgeoning technology and changing consumer habits, according to a new report from BMO Capital Markets.

On November 7th, the Canadian big three national wireless carriers each unveiled new pricing plans within hours of each other. The new, simplified plans boast unlimited talk and text as well as data buckets that can be shared by family members and their varied devices that are all on the same household account. The BMO report says the shift, in the short term, may prove negative “as ‘price optimizers’ (anyone paying local voice overage or with multiple data plans) are likely to reduce their total bill,” reads the report by analyst Tim Casey.

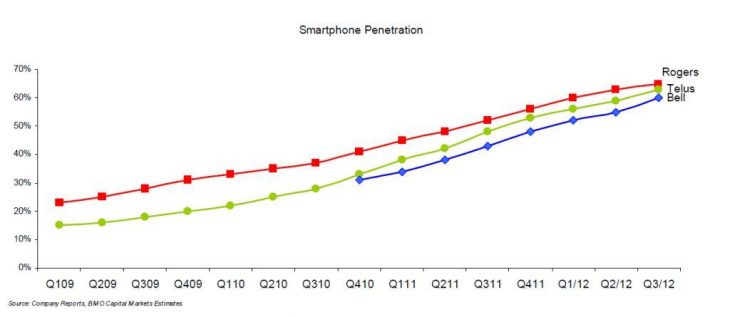

However, the move will be a positive one over the long term “as data consumption increases from more devices attaching to the network,” adds the report. The moves made by Rogers, Bell and Telus are similar to what is going on in the rest of the world, says the report, which points to similar moves made by AT&T and Verizon earlier this year.

While voice declines and data grows, shared data plans simply make sense as consumers shift to smart phones and tablets to text, Tweet and Facebook and consume video content, rather than make phone calls. “Shared data plans are intended to generate greater adoption of data-only devices and, in turn, data usage on carriers’ wireless networks,” and therefore, revenue, says the report.

“By definition, a data-only device carries a lower ARPU profile than that of a smartphone, given that it lacks a voice component. That said, lifetime profits from data-only devices are attractive, as they carry little, if any, device subsidies.” For example, no carriers subsidize iPads with SIM cards for use on a cell network.

“While each incremental data-only device added to a carrier’s network may be dilutive from an ARPU perspective, by expanding the addressable market for data-only devices (tablets, USB stick, hotspots, etc.) and applications (video, M2M, mobile banking, home automation, auto connectivity, etc.), data revenue and EBITDA are expected to continue to grow,” writes Casey.

Shared data plans should also improve churn, a metric all carriers said is their top priority in quarterly results releases and in conference calls with the financial community. “The thesis is that a subscriber would be less inclined to switch carriers when it has multiple devices sharing a single data plan all attached to the same carrier’s network,” reads the report. “As wireless penetration rates plateau and subscriber growth slows, churn and retention are expected to become a more meaningful metric going forward.”

Casey noted, too, that the demand for data shows no sign of slowing, pointing to a Cisco report saying it will increase at a compound annual growth rate of 77% from now until 2015, driven of course, by mobile video and connected mobile gaming. Ironically, those games (and other apps) feature voice communications, meaning customers are still talking to one another, but through apps running on their data plans and not on the traditional voice portion of the cellular networks.

Some global carriers – like MetroPCS in the U.S., have launched rich communications services (with the joyn brand) which link social networking, voice and video over IP and file sharing as a defense against over the top communications applications, notes the BMO research.

The aforementioned day of price plan changes also asserted how competitive the market is and how fast companies must move – but also how the big three still dominate the top end of the Canadian marketplace and that the newcomers using AWS spectrum are still struggling at the other end. “With ARPUs reported below $30, new entrants had an impact on dragging down incumbents’ ARPU on the low-end segment. It is worth noting that new entrants continue to face a challenging economic model with this pricing and we believe consolidation is inevitable. New entrants represent a very small portion of overall wireless subscribers (<5%) and have fallen short of their expectations of growth,” reads the report. “Wind Mobile, for instance, originally had a target of 1.5 million total subscribers by the end of 2012. As of Q3/12, WIND had 510k subscribers. We continue to expect some consolidation among the independent new entrants.”

Casey also drew a cautionary tale based on the experience of Netherlands-based wireless carrier KPN, whose voice-focused pricing structure back in 2011 caused huge headaches. Data was unlimited while texts and voice minutes were metered, which meant, “subscribers were financially incentivized to go ‘over-the-top’,” and KPN saw Q1 2011 revenue plunge 8% and its stock drop by 9%.

As the market changes and technology develops (and new spectrum becomes available), watch for the Canadian wireless carriers to continue to tweak their pricing and plans (maybe not all on the same day again) to keep churn down and revenue coming in, said Casey, worried less about their average revenue per user or per service and more about the overall revenue per account.

– Greg O’Brien