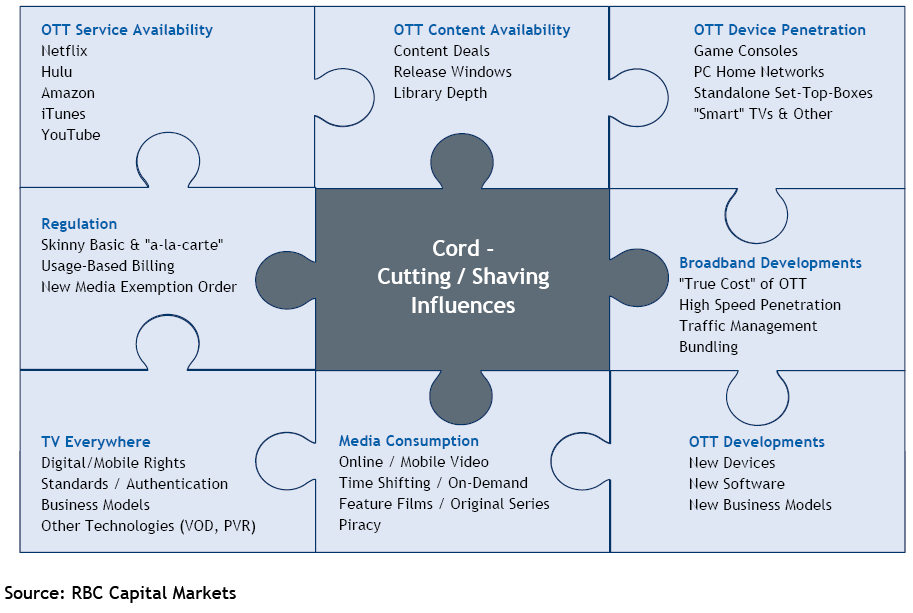

CORD-CUTTING, OR SHAVING, could take a big, 1.7-billion-dollar bite out of Canadian television distribution revenues by 2017, according to a new report from RBC Capital Markets.

While that sounds pretty painful, the reports authors call that a modest hit to an industry which pulls in some $10 billion annually. The real challenge will be after that, during what they call the 2017-’19 inflection period, where cord-cutting could really accelerate, especially if over-the-top video services grab much more of the premium programming and the traditional industry isn’t proactive.

“Prior to our OTT inflection period, we do not expect the financial impact of cord shaving to be overly disruptive as distributors continue to exercise control over channel pricing… and to a large extent channel packaging,” says the report. “However, some cord shaving is still likely to occur leading up to our OTT inflection period driven by: (i) regulatory pressure on distributors under the new vertical integration framework in Canada to prove steps are being taken to respond to perceived consumer demand for more television choice…; (ii) a growing need to counter increased video piracy as broadband capacity increases; (iii) intensifying television competition between the cablecos and telcos, which could accelerate the industry’s migration to more open and flexible all-IP home data networks; (iv) rising OTT competition, which we expect to put upward pressure on programming costs and television prices for consumers thus ultimately straining household video entertainment budgets; and (v) declining technology costs for distributors in delivering greater packaging flexibility.”

In the face of all that, say the report’s authors, there is much that can be done to mitigate that $1.7 billion revenue hit by 2017 – and besides, the TV distributors can more than make up for it on the broadband end of their ledgers.

While it’s hard to predict the future with certainty, especially in the fluid, ever-changing global media marketplace, most inside and outside the industry assume that over the next many years, Canadians will source an increasing number of hours of their favourite video content from someplace other than a Canadian broadcaster, cable company, satellite distributor or telco IPTV provider, delivered via something other than a cable or satellite set-top box.

“The main drivers of our substitution forecasts are growth and penetration assumptions for OTT devices, which in turn stimulate demand for OTT video consumption. These devices include: (i) game consoles; (ii) PC home networks that use media servers or other technologies to stream video from the PC to the television; (iii) standalone set-top-boxes, including AppleTV, Tivo, Boxee; and (iv) ‘smart’ TVs, connected Blu-ray players and other devices. In addition to these four ‘buckets’ of OTT devices, we also factor in a fifth ‘bucket’ consisting of direct-to-PC households, which view OTT content directly on PCs and other non-television devices,” reads the report.

And those who cut the cord completely to go with one or more of the above options with, say, an off-air TV antenna, may number as high as 1.3 million households by 2017, accounting for $1 billion less revenue for TV carriers in five years. The report also predicts a modest increase in the number of over-the-air TV households over that time.

Paradoxically, it’s not the heavy viewers who will cut the cord in favour of OTT, but the light viewers who don’t need or want to see everything and will be happy with a modest handful of options.

A new online video market looks poised for massive growth over that same time period, too, as the RBC report predicts revenue there to rise from $150 million in 2010 to $2.3 billion by 2017 in Canada thanks to three factors: OTT subscription revenue (from the likes of Netflix, which is available in Canada now and Hulu Plus or Amazon Prime Instant Video, which will be here eventually); OTT transaction revenue, such as movie rentals or purchases from iTunes; and online/mobile video advertising.

While not many are going to want to cut that cord completely, those who cut back, or shave down that cord a little, will likely account for a further $700 million revenue haircut for the TV distributors by 2017, the report continues. Strengthened OTT options, coupled with the CRTC’s insistence that Canadians be given more choice from their TV providers, a sour economy and the increased costs associated with paying for cable as well as some of the OTT options, will see many Canadians pare back their level of subscription. “Canadians may very well have an ‘insatiable appetite’ to consume more media on multiple platforms, but the ability and willingness to incrementally pay for this content remains up for debate. Our cord-shaving forecast assumes that OTT households that remain BDU subscribers seek ways to reduce spending on other forms of video entertainment,” reads the report.

Despite the loss in traditional TV subscription revenue, the RBC report expects the top line drop to be offset from the increased revenue earned by the carriers’ broadband offerings. “Fortunately for distributors (and in contrast to most other substitution precedents in the media and communications sector), substitution risk is somewhat mitigated by: (i) a reasonable opportunity to re-capture foregone revenues given an oligopoly-based industry structure where distributors can exercise control ‘over the pipe’; and (ii) a substitute – data – that is capturing the value of global mobility and interactivity and hence likely to grow rapidly,” reads the report. “Assuming a competitive data network, the extent to which data growth can offset accelerated substitution effects for television will largely depend on: (i) the trajectory for data volumes and (ii) the ability to monetize data demand.”

And that data volume growth is expected to remain “explosive”, says the report – not to mention every other bit of evidence available these days. “For wireline data pricing, we expect most distributors to continue to increase the monthly base prices for Internet offerings by $2-$3 annually on average, while concurrently providing higher data speeds and data caps within these offerings at low marginal cost,” reads the report. “Given the IPTV inroads by the telcos, we expect the cablecos to continue to be the most aggressive in increasing data speeds and data caps, both as a means of bundle differentiation and to exploit a growing pipe advantage versus DSL. While this pricing strategy should translate to a steady decline in the price per GB for consumers, increases in data consumption should translate to Internet revenue growth for distributors.”

In all, the shift to OTT may not hurt all that badly, for distributors. “By 2017E, we estimate that cord cutting and cord shaving combined could impact television revenue and EBITDA for distributors by $1.7 billion and $1.1 billion, respectively, representing 13% and 27% of potential distribution revenue and EBITDA, respectively. But how effective a hedge will the Internet be? Our analysis suggests that distributors could recover over 70% or $800 million of the $1.1 billion in forgone EBITDA resulting in a net EBITDA impact for the industry of approximately $300 million by 2017E,” reads the report.

“Other key findings from our analysis: (i) the net EBITDA impact of cord-cutting is positive (~$150 million in 2017E) reflecting data caps and overage charges as well as the positive impact of gaining incremental Internet subscribers; and (ii) the net EBITDA impact of cord shaving is negative (~$450 million in 2017E) reflecting our assumption that data consumption for cord shavers remains below existing data caps and thus not subject to overage charges.”

TV: Just another app

The study’s authors, led by analyst Drew McReynolds, believe the industry as a whole will pursue a “less disruptive path forward,” that makes consumers want to stay with a traditional TV supplier: the Premium Promotional Bundle. The PPB would be the exclusive, first-run window for premium television programming, or new shows which can’t be seen elsewhere. Those shows would be heavy on programming that has to be seen live, like sports, reality programming and events like the Oscars.

Pointing to what happened in the music industry, when record companies either ignored what was happening, digitally, around them or tried to do a bunch of different things on their own to try and protect a business model under attack, the RBC report says the Canadian and North American TV industry, given its lucrative existing business model and the fact that so many are now vertically integrated operations (Rogers/City, Bell/CTV, Shaw/Global, Videotron/TVA, Comcast/NBCU, Time Warner), it behooves the lot of them to work together. “Piracy was the catalyst in the music industry that ceded retail aggregation to Apple (permanently tilting music economics in favour of a software/hardware provider). Television distributors in conjunction with broadcasting partners still remain the dominant retail and wholesale aggregators for television content, and presumably want to avoid the same fate,” says the report.

The PPB, says RBC, is a path forward from the walled garden approach of today’s TV carriers and “may: (i) preserve a bundled pricing model and associated economic benefits for the television industry; (ii) enable television distributors to transition from television, Internet, and telephony services providers to all-IP home data network providers; (iii) throw select broadcasters (the most vulnerable in the new media value chain) a lifeline that prevents disintermediation; and (iv) create the desired subscription-based pay-walls for content providers…

“The PPB would become one of many subscription-based services distributed across an all-IP home data network along with other innovative retail aggregation services (creating a new form of ‘à-la-carte’ for consumers where the PPB is analogous to a ‘channel’ or ‘app’).

If this doesn’t work, and the switch to OTT swings into a higher gear and data usage continues to skyrocket, what happens then? Watch for the carriers to think about getting out of the content aggregation game altogether to be just the network company. “Assuming growth in data revenue becomes an effective hedge for declining television revenues, distributors might be less incentivized to remain a television retail aggregator (albeit at the risk of greater network commoditization) in what will be one of the most competitive parts of the new media value chain,” says the report.

“Should distributors ultimately exit retail aggregation to focus on the home data network and other network core competencies, such as wireline-wireless integration and specialization (i.e., far from a dumb pipe), a mechanism to monetize and transfer TV Everywhere authentication, authorization and customer billing functions to interested wholesale and/or retail aggregator(s) would be required. Simply put, our less disruptive path forward envisions the PPB becoming platform agnostic where it is lucratively syndicated/embedded as the core first-run, premium video offering of all major retail aggregators on a global basis (i.e., Apple TV, Google TV, Facebook etc.) – and needless-to-say true interactive television would be born.”