TIMMINS – It’s hard to disagree with Northwestel’s assertion that when it comes to telecom operations, it is like no other.

The Bell Canada-owned company’s networks cover about 115,000 people spread across 40% of Canada’s total land mass – or four million square kilometres.

To say “there are important differences between the environment and the provision of telecommunications services in the far north as compared to the rest of Canada,” as the company’s president and CEO, Paul Flaherty told the CRTC Tuesday morning in Timmins, is quite an understatement.

Flaherty appeared in front of commissioners during day one of the Regulator’s obligation to serve proceeding, CRTC 2010-43 and told them his company carries some rather heavy obligations – and that the traditional services which supported those are coming under attack.

In no way does it want to see any additional, new obligations added. It can’t afford any. Part of the proceeding will decide whether or not the Commission will (or even can) expand the telcos’ basic service objective – as well as the subsidy regime that goes along with it – to include broadband. Northwestel and the other incumbent telcos and cablecos have objected.

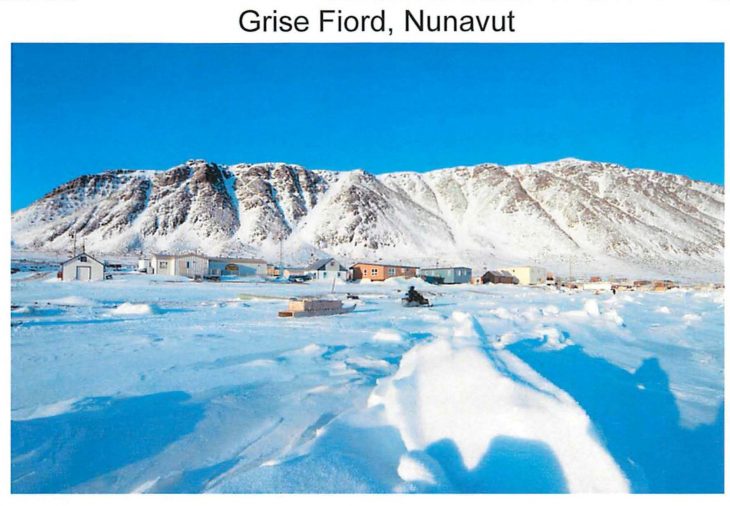

The CEO highlighted a couple of extreme examples. Grise Fiord (pictured, from the company’s presentation) is in the high Arctic and has 118 telephone lines serving a population of 161 people. Northwestel’s capital investment in the community is $27,746 per line and the cost to service the place if there are problems is a 1,500 km flight which costs $4,359 (now that’s a “truck roll”, to use the industry’s service vernacular).

“In addition to the high annual costs of satellite transponders, regardless of the size of a community, all satellite communities require minimum equipment such as; a digital switch, RF equipment, required software, IP equipment, satellite earth stations (up to 9 meter diameter dishes), buildings and HVAC power equipment,” he said. And maintenance.

The company also operates 137 microwave sites and has to generate its own power at 95 of them. In Parsons, NWT, 50 kms north of Nunavut (the site is pictured), “fuel must be transported from Inuvik up the Mackenzie river by ice road and then slung by helicopter from the river to the tower on a ridge overlooking the river delta. Capital invested at this site required to generate our own power is over $1 million. Moreover the company spends about $76,000 in annual operating costs at this site,” he added.

The similarities between Northwestel and other telcos is that they provide voice and data services to customers. How they deliver those signals is another thing entirely and Flaherty cautioned the commissioners to be mindful what they add to his company’s obligations through this proceeding.

“Many services, like long distance and business access, are uneconomic in many of our remote high cost communities and are currently cross-subsidized from services provided in larger communities,” he noted (and those “larger” communities, Yellowknife and Whitehorse, are both smaller than Timmins).

“However, these traditional sources of implicit cross subsidies are declining as consumers take advantage of technological change and utilize lower margin IP services including VoIP. For example, Northwestel estimates that VolP calling has grown in our territory by 40 times since 2006 and now represents nearly 10% of our customers’ long distance calling.”

Add to that various government programs which have subsidized duplicate networks in some regions and revenue is waning, making it harder and harder to function and meet the company’s existing obligations, said Flaherty.

“With the declining implicit cross subsidies, and the significant market disruption caused by competing subsidized networks in uneconomic regions, Northwestel will not have the means to maintain the obligation to serve and to be a full service provider in uneconomic areas without further modifications to the subsidy mechanism,” he added.

BELL ALIANT IS urban when compared to Northwestel. From the tip-top of Quebec to southwestern Ontario, from the westernmost regions of Ontario to New Brunswick, Nova Scotia, PEI and Newfoundland & Labrador, Bell Aliant serves fully half of all high-cost serving area customers in Canada. (However, it also serves all of the towns and big cities in our four easternmost provinces.)

“Our company is at a crossroads,” Denis Henry, vice-president of legal, regulatory and governmental affairs told the CRTC Tuesday morning. “(W)e face declining revenue and profitability in an intensely competitive marketplace.”

With competition either established or emerging for rural customers, there is no need to do add broadband to its basic service obligations, added Henry, who pointed to the upcoming launch of high capacity satellite broadband and 4G wireless service from Barrett Xplore, which presented its case today, too.

The market – even at the rural level – is taking care of broadband demand.

“Regulatory intervention could actually damage the industry and have major unintended consequences,” Henry added, “particularly for companies like ours who are engaged in a fierce competitive struggle as we try to rebuild our networks to remain relevant to our customers.”

And as for the local subsidy regime that pays for the existing obligations? “To be blunt, that regulatory mechanism is broken – resulting in large transfers of funds from Bell Aliant to others. We can no longer afford this state of affairs.”

(Ed note: We’ll have more on the subsidy regime tomorrow when SaskTel and MTS Allstream face the panel.)

WIRELESS BROADBAND company Barrett Xplore (and by wireless, we mean satellite, too) can provide broadband service to virtually anyone in Canada via fixed wireless or satellite. It has 135,000 customers (one of whom is CRTC chairman Konrad von Finckenstein) and insists no subsidies are needed for rural broadband because it and others are already offering high speed solutions to Canadians living in those last houses down all those long dirt roads.

The company is focused on the 5% of Canadians in rural areas who can not get broadband access in the traditional ways and Maduri noted that broadband of up to at least 1.5 Mbps is available across the country already.

And with its new high throughput satellite, which will be ready for service in the second quarter of 2011, assuming no technical snafus, those speeds will rise to 10 Mbps for consumers and up to 25 Mbps for businesses. The company will also launch the first 4G fixed wireless network in Canada come December.

Maduri noted that its cutting-edge wireless solutions are far more efficient than the wired way the Commission is forcing telcos to deploy via the deferral accounts decision which Bell is appealing.

“

“In contrast, in a competitive bidding process, Barrett received a government subsidy of $13 million to provide service to an estimated 39,000 households in New Brunswick in physically demanding terrain covering a geographic area of almost 73,000 square kilometres – a subsidy of approximately $333 per subscriber or only 7% of Bell’s subsidy per customer.”

And so far, Barrett has been able to convince a third of those 39,000 households to become subscribers, said Maduri.

The more one hears and sees of these companies, the more you begin to believe that the market is beginning to take care of bringing broadband to everyone’s doorstep.

The hearing continues today (including some scheduled who say market forces are not enough) and Thursday in Timmins and picks up again next week in Gatineau.