Nearly half of focus group respondents said a program’s country of origin didn’t matter

By Ahmad Hathout

The majority of Canadians can identify Canadian programming when looking for something to watch on cable, satellite or online streaming services, a new survey-based report commissioned by the CRTC found, while a larger majority chooses to watch content based on entertainment value and quality.

The “Perceptions of Canadian Programming and News” study, delivered last month by Ottawa-based Phoenix Strategic Perspectives Inc., found 60 per cent of surveyed Canadians said they could identify Canadian programming, 25 per cent said they could not, and 16 per cent said they were uncertain. (Methodology is at the bottom.)

Nearly three-quarters, 72 per cent, said they identify Canadian programming as stories that are set in a Canadian location, followed by programming that reflects Canadian realities (58 per cent), those that include Canadian actors (56 per cent), those that feature Canadian stories (51 per cent), and those that have Canadians operating behind the camera (29 per cent).

Others (12 per cent) identified Canadian programming, the report goes on, by word of mouth, program credits, whether it includes the Government of Canada logo at the end, language of the production, the network on which it airs, and lower production quality — though the report notes that other participants equated “Canadian programming” with quality.

Canadians under 35 were more likely than older Canadians to say they cannot identify Canadian programming, the surveys noted.

The report is part of the work the CRTC is doing to implement rules ushered in by the Online Streaming Act, which brings foreign streamers under regulation. Part of that effort is figuring out how traditional Canadian and foreign streamers can improve the discoverability of Canadian content.

When it came to discovering new Canadian content to watch, 54 per cent reported suggestions came through television, streaming services and ads, 48 per cent said they came through social media, 39 per cent said they came through articles or segments in the news, and 55 per cent said they came from friends and family.

Canadians under the age of 35 were least likely to report discovery from suggestions and advertisements from TV and streaming services or from news content, the report noted.

Still, the vast majority of the surveyed group chose video programming based on entertainment value (72 per cent) and overall quality (72 per cent) and relied much less so on cultural relevance, which made up just 35 per cent.

Three-quarters of those surveyed said they watch Canadian programming frequently (28 per cent) or occasionally (46 per cent), while 16 per cent said they do so rarely and two per cent said they never do.

The study, however, also found that cultural relevance and language, which was 30 per cent of the pie, were “more likely” to influence the viewing decisions of members of the official language minority communities (OLMCs), especially among the French-speaking community. The French OLMCs, it went on, were also less likely to place importance on entertainment value.

Racialized respondents were more likely to point to diversity of content, which made up 28 per cent, when making a viewing decision. Meanwhile, Canadians with disabilities were more likely to mention genre preference (51 per cent of all respondents) and accessibility (16 per cent of all respondents), while cultural relevance, genre preference and diversity were more likely to drive decisions among members of the 2SLGBTQI+ community.

Respondents ranked Canadian jobs in the entertainment industry (58 per cent) and Canadians having creative control over their productions (58 per cent) as the top economic priorities, followed by Canadian programming being well funded (51 per cent) and Canadians having financial control of their productions (50 per cent). Nearly half, 48 per cent, said they placed a high level of importance on productions being filmed in Canada, while 47 per cent said country of origin is not very or not at all important and 52 per cent said it was somewhat important or very important.

“While Canadians value Canadian programming, country of origin is not important to almost half of those surveyed,” the report said. “To understand this apparent contradiction, focus group participants provided some perspective when asked to explain why they watch Canadian programming. Indeed, the reasons for choosing programming are driven more by its news and entertainment value rather than elements of Canadian content.”

While drama and comedy topped the list of genres of video programming favoured among the respondents, when it came to Canadian content specifically, news and current affairs (81 per cent) were what mattered most. Most of the Canadian news consumption came online (66 per cent), followed by cable or satellite TV (49 per cent), then social media (46 per cent), radio (43 per cent), print newspapers (15 per cent) and podcasts (15 per cent).

The respondents prioritized trustworthiness, credibility, reliability and in-depth reporting when it came to the news.

After news and current affairs, respondents said they most enjoy Canadian comedies, drama series or fictional stories (48 per cent), documentaries on Canadian topics (41 per cent), Canadian sports (36 per cent), indigenous stories and perspectives (16 per cent), programming that reflects a diversity of Canadians (10 per cent), and other types of programming (three per cent), including animation, reality shows and historical content.

The report also touched on artificial intelligence in news programming, with widespread concern among the respondents relating to how the technology could impact the quality and reliability of that programming.

The report was based on two parts. There was a 10-minute probability online survey conducted from November 15 to December 5, 2024 with 1,226 Canadians aged 16 and older, which included an oversample of Canadians living in rural areas or northern communities and those living in English and French OLMCs. The margin of error is plus or minus 2.8 per cent, 19 times out of 20.

Then there were eight, 90-minute virtual focus groups conducted between November 13 and 21, 2024 with Canadians aged 18 from English and French OLMCs, equity-deserving groups, those living in rural areas or in the territories, those from urban areas, those who are racialized, identify as 2SLGBTQI+, women, and persons with disabilities.

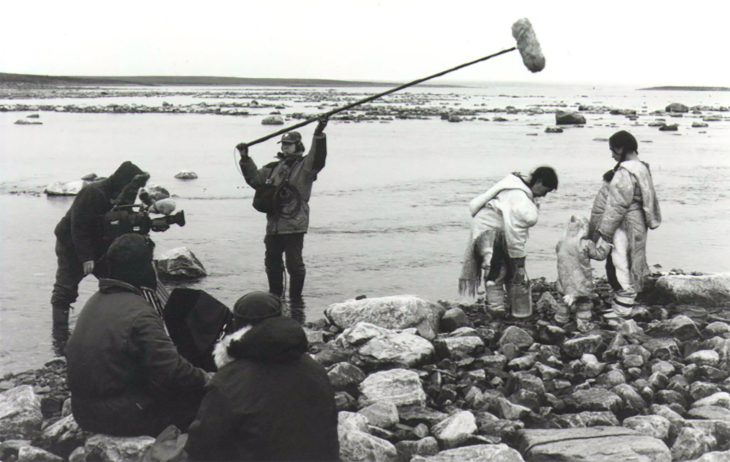

Photo via Uvagut TV